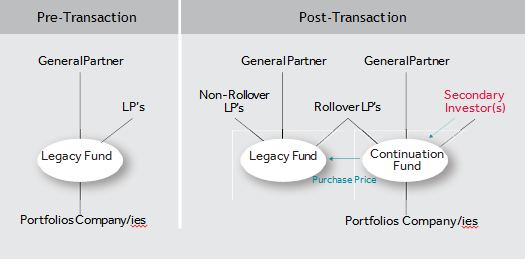

Navigating the Nuances of Continuation Funds | 12 | 2020 | Publications | Insights & Publications | Debevoise & Plimpton LLP

The Emergence of Continuation Funds: Faster and More Furious Than Ever | Penn Mutual Asset Management

Private equity funds workplace pensions should avoid | AgeWage: Making your money work as hard as you do

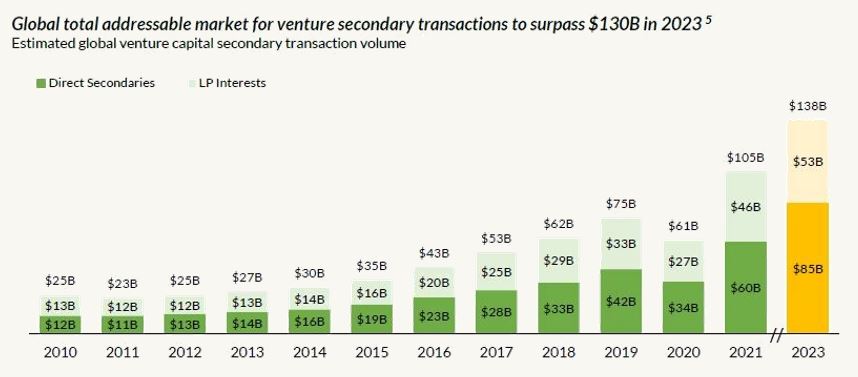

How Big Is the Secondary Market for Venture Capital? An Updated View to a $130B Market - Industry Ventures

Let's Stay Together: Why PE Firms Are Committing to the Long-Haul Via Continuation Funds - Lincoln International LLC

Travers Smith's Alternative Insights: The benefits of a well-structured continuation fund | Travers Smith