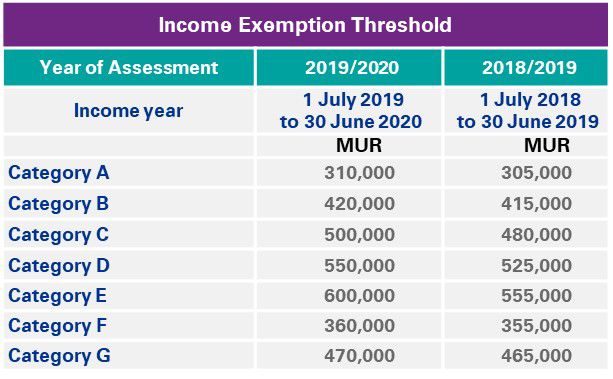

Deloitte Mauritius on Twitter: "#mauritiusbudget2020 Updates so far. Stay tuned for more #budget2020 #mauritius https://t.co/jbyEVI9fQ9" / Twitter

Andersen in Mauritius - Did you know that Solidarity Levy of 25% may also apply on dividend received from a resident company? For clarifications and more information on the Solidarity Levy, click

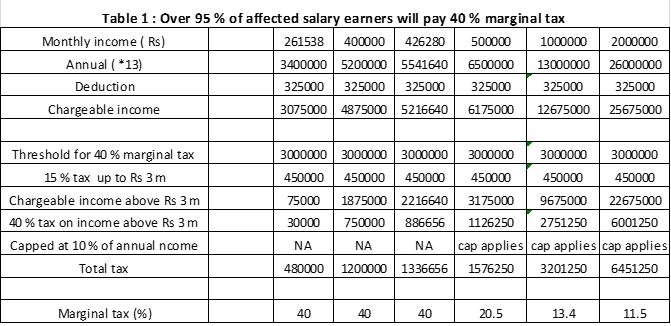

Tax Alert: Amendments to PAYE calculations on solidarity levy for individuals earning more than Rs 3m

Tax Alert: Amendments to PAYE calculations on solidarity levy for individuals earning more than Rs 3m

Tax Alert: Amendments to PAYE calculations on solidarity levy for individuals earning more than Rs 3m